EspañolBrazil’s economy will suffer a 2.8 percent contraction in 2015, and a 1 percent shrinkage in 2016, according to a press release by the Economic Commission for Latin America and the Caribbean (ECLAC) on Monday, October 5. The entity also foresees a drop in regional economic growth from 0.5 percent to -0.3 percent this year.

In the release, ECLAC states that economies from South America will register the greatest decline. The report points to countries specializing in raw materials (petroleum and minerals), as well as those with highly integrated commercial relationships with China, such as Venezuela and Brazil, in particular.

Brazil is currently in the midst of a growing economic crisis. On Monday, Finance Minister Joaquim Levy highlighted the need for the Dilma Rousseff government “to focus on fiscal stability and judicial security” to achieve financial growth.

“The political crisis stemming from the Petrobras investigation has created uncertainties, and this has affected consumer and corporate trust [in the economy],” International Monetary Fund (IMF) General Director Christine Lagarde told O Globo in an interview.

In September, the Brazilian real dropped to its lowest value in history. Further, on September 9, risk-assessment agency Standard & Poors downgraded Brazil’s rating to BB+, effectively stripping the real from the investment-grade credit standard it once held.

Brazilian Companies Migrate to Paraguay

Conversely, Paraguay is one of the few countries in the region that enjoys economic growth. At least 40 Brazilian companies — encouraged by the National Industry Confederation (CNI) — have decided to transfer part or all of their production lines to Paraguay. The CNI says that the current Paraguayan government is “business friendly” and enjoys political stability.

Paraguay offers Brazilian business owners various incentives, such as more affordable electricity, lower taxes, and the so-called Maquila Law, which establishes a tax exemption for foreign companies that import raw materials and machinery, so long as they export the finished product.

Furthermore, in Paraguay, the income tax (ISLR) and value-added tax (VAT) are each set at 10 percent. In Brazil, however, businesses must pay 25 percent in income tax, as well as three other taxes that add up to over 25 percent.

According to Brazilian daily Folha de Sao Paulo, the industrial gas manufacturer Oxygroup has closed its operations in Pará, Minas Gerais, and moved to Paraguay, investing more than US$7.5 million in the transfer.

Folha also reports that there are five Brazilian toy manufacturers in the final stages of their feasibility research to determine whether to open operations in Paraguay.

Internationalization on the Upswing

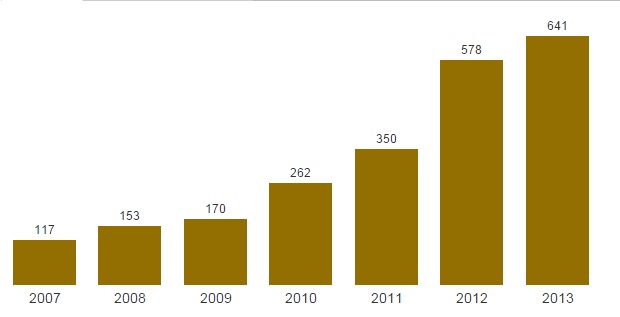

According to Dom Cabral Foundation business school (FDC), the internationalization of Brazilian companies has intensified due to the domestic economic crisis.

FDC professor Sherban Cretoiu says that “the search for technology, new management, and competitive processes” all play a role in why Brazilian multinationals seek foreign sites for their operations.

[adrotate group=”8″]

One FDC survey notes that 13.6 percent of participating companies expanded investments in external markets and reduced them in the domestic market; while 29.5 percent increased investments abroad and maintained their efforts in Brazil.

The report also reveals that 20 Brazilian multinationals have established operations in 33 new countries. South America leads in Brazilian enterprise investment with 82.2 percent, followed by North America with 69.3 percent.

Versión Español

Versión Español