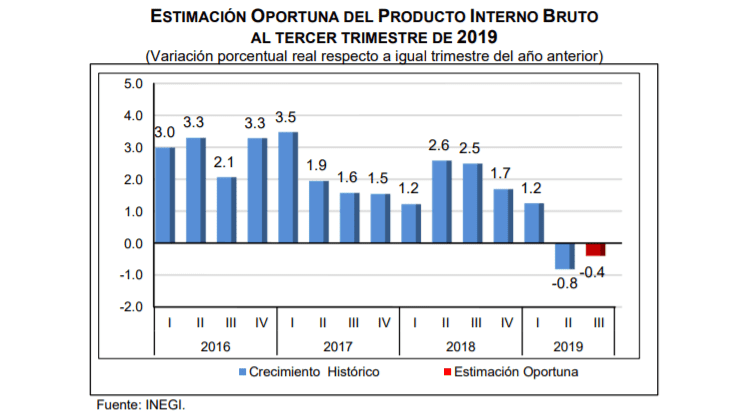

Mexico’s economic landscape is bleak. The economy has not grown since Andres Manuel Lopez Obrador (AMLO) assumed power in December 2018, and the Gross Domestic Product (GDP) is in the red: it registered a contraction of 0.4% per annum in the third quarter of 2019, according to the National Institute of Statistics and Geography (Inegi).

The last time Mexico hit such a low was in the final quarter of 2009 when it was facing the consequences of the global economic recession that primarily affected its neighbor, the U.S., following the housing crisis.

Today, the U.S. is at its best economic moment since the time official records are available (150 years). In mid-June, the U.S. broke the historical record of 121 months of uninterrupted economic growth and is still on track. Additionally, last year, Donald Trump’ s administration achieved the lowest unemployment rate in half a century. The International Monetary Fund (IMF) reported that U.S. GDP is increasing, and 2019 would close with a rise of 2.3%.

However, Lopez Obrador has not taken advantage of the economic growth in the United States, even though Mexico is the country with the highest exports to that country. The policies promoted by the Mexican president have not allowed his country to take advantage of the neighbor’s bonanza.

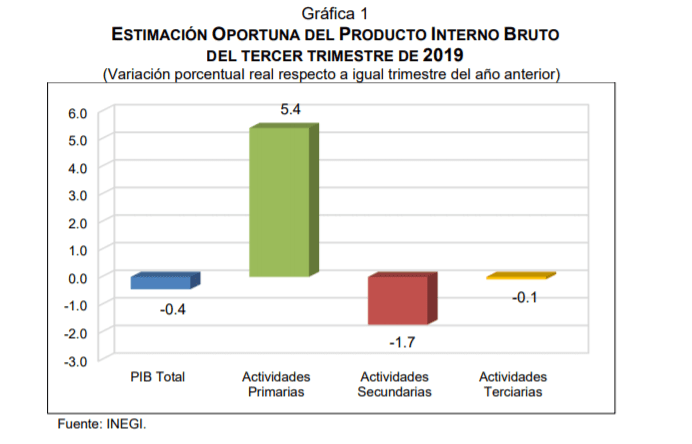

Although primary sector activities in Mexico increased by 5.3%, secondary sector activities decreased by 1.8%, while tertiary sector activities have remained stagnant since last year.

En el tercer trimestre de 2019, la Estimación Oportuna del Producto Interno Bruto #PIB aumentó 0.1% frente al trimestre previo, y tuvo una reducción real de (-)0.4% en su referencia anual (cifras desest) #INEGI #ComunicadoINEGI https://t.co/cke1JcDBgS pic.twitter.com/MbPnrVvVkq

— INEGI INFORMA (@INEGI_INFORMA) October 30, 2019

The Timely Estimate of quarterly GDP reported a real increase of 0.1% in the third quarter of 2019 compared to the previous quarter, according to INEGI.

Compared to 2018, in the first nine months of the year, the economy had a 0.0% variation in the real percentage. And there are no indicators that show signs of change. On the contrary, since similar figures were published in the second quarter, there have been signs of an imminent recession.

??Mientras la ignorancia los lleva a decir #CadaVezSomosMasConAMLO…

?La realidad económica demuestra que somos más pero los que vamos a pagar la factura de sus pésimas decisiones.

????EEUU crece a una tasa increíble del 3.2%, México está en recesión. pic.twitter.com/9fhBCbG1TW

— Alan Adame (@AlanAdameMX) July 18, 2019

According to the data, Mexico is at the worst moment in recent years, even showing a negative balance.

The world’s leading risk rating agencies changed the classification of Mexico’s economy from stable to negative due to the economic policies of Lopez Obrador.

According to credit-rating agency Moody’s Investors Service, economic policies under the left-wing president are less predictable, which negatively affects both investor confidence and the medium-term economic outlook.

The ratings of these agencies are essential for foreign investors. Therefore, Mexico has virtually closed its doors to investments.

The excessive growth of the state machinery under Lopez Obrador’s administration is one of the primary causes of the negative economic outlook. Bloomberg reported that in the first four months of 2019, the construction of a single refinery had increased the expenditure of the Ministry of Energy by 364%, compared to the previous year.

Instead of alleviating the state’s finances with bids to private companies, Lopez Obrador gave oil concessions to the already bankrupt state company Pemex. According to the rating agencies, this puts future fiscal accounts at risk.

The most symbolic case was that of the Dos Bocas oil refinery. Instead of receiving eight billion dollars from an external investor, Lopez Obrador canceled the bidding and kept the construction of the oil refinery under the state monopoly. In other words, Lopez Obrador not only prevented funding but also aggravated the finances of the already bankrupt Pemex.

Another example of Lopez Obrador’s decisions allowing the country’s economic growth was the cancellation of Mexico’s New International Airport (NAIM), which promised to expand the export market, coupled with increased revenue from tourism. As a result, the debt (4.2 billion USD) incurred by the government of Enrique Peña Nieto for the construction of the airport became part of the negative balance. Once the president’s decision not to proceed with construction was made official, the value of the bonds issued plummeted. In less than two months, the secondary market valuation fell by 15%.

Although the current figures are not encouraging, Inegi warns that the traditional quarterly GDP figures, which will be published on November 25, 2019, could change. However, the trend is downwards, and Lopez Obrador has shown no interest in opening up to the world.

??Mientras la ignorancia los lleva a decir #CadaVezSomosMasConAMLO…

?La realidad económica demuestra que somos más pero los que vamos a pagar la factura de sus pésimas decisiones.

????EEUU crece a una tasa increíble del 3.2%, México está en recesión. pic.twitter.com/9fhBCbG1TW

— Alan Adame (@AlanAdameMX) July 18, 2019

Versión Español

Versión Español