Brazil started the month of February as the global emerging markets leader, and has quickly established itself as a Wall Street favorite this year. According to experts, the election of Jair Bolsonaro offers great prospects for the largest economy in Latin America.

68% of the investors surveyed by Santander expect that Brazil will be the country with the highest yield for Latin American shares.

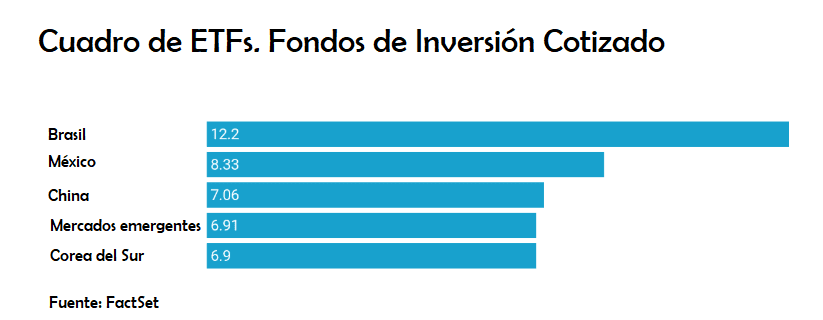

The highlight thus far has been shares the MSCI Brazil Capped ETF index (NYSEArca: EWZ), the largest Brazilian securities trading fund in the United States. So far this year it has grown by 12.2%. That equates to USD $147.4 million in capital gains.

Each country has its own ETF; in the case of Brazil, it has outperformed the broader emerging markets funds, with the benchmark MSCI Emerging Markets Index up 6.5% so far this year.

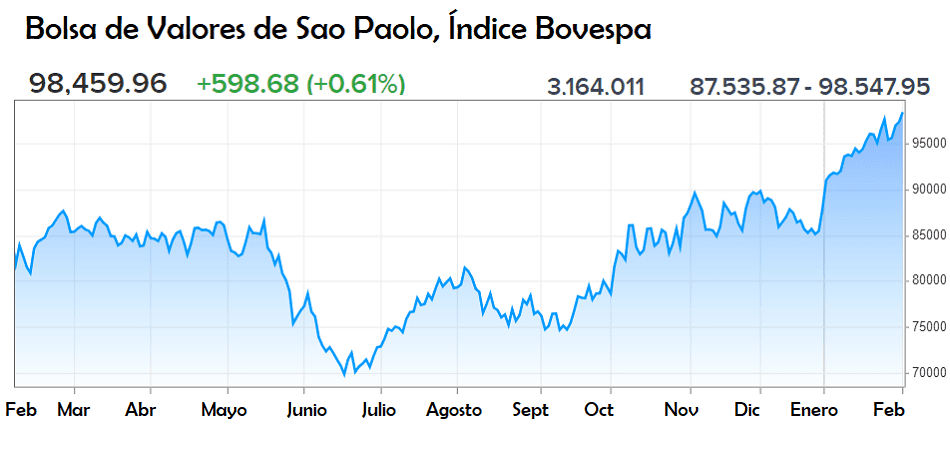

According to the Bovespa index, the Sao Paulo Stock Exchange reached a record high on the last Monday in January: it has risen more than 8.5% so far in 2019.

According to Chen Zhao, the head of strategy of Alpine Macro, an independent investment research firm that provides unique perspectives on the macroeconomic and financial markets, Bolsonaro is “playing all the right notes that the market has wanted to hear for years.”

He added that this is why he believes that the reaction of the market has been so positive: “if he really fulfills what he promised, I believe that it could become an important step for supply in the world of emerging markets.”

The fact that the new president of Brazil won with a commanding 55% of voters, also gives security to investors. It is an indicator of stability in his mandate, as well as confidence in his government.

For ETF System, an investment fund news platform, the most influential factors in Bolsonaro’s victory were his tough stance on crime hand in hand with the lack of growth in the economy. Since the candidate promised to fight the first and improve the second, he achieved a considerable victory.

Hand in hand with a massive fall in oil prices, the Brazilian economy contracted throughout 2016. During the years of consecutive governments under Workers’ Party, of socialist economic orientation, policy tended towards a centralized and planned economy, as happened in Ecuador and Venezuela. When the price of oil collapsed, the three countries were seriously affected, as well as their respective political projects that had been fueled by the oil bonanza.

In 2017 there was a turnaround, but the economy only grew by 1.1%. According to the data compiler FactSet, quarterly GDP growth did not reach 1% in the first three quarters.

Brazil’s economy was seriously hit in 2016 in the wake of the impeachment of President Dilma Rouseff, as her Workers Party reeled from implication in the Lava Jato money laundering network: the same that condemned her predecessor, former President Lula Da Silva to prison. Political instability had major repercussions for the economy.

Now, according to experts like Jens Nordvig, founder of Exante Data, the tendency of the Brazilian economy will be to grow much faster.

“They just had the biggest recession, literally, in the history of economic statistics,” he says.

“Coming out of a recession like that, they should have seen growth of 4, 5, 6, 7% for several years and they just have not had it,” Nordvig said.

He explains that one of the reasons why they have not achieved these figures is because of Brazil’s structural problems, including the pension system.

Given that Bolsonaro announced that the pension system will change, there was a new injection of capital into the Brazilian market. Pension reform will remove a major structural impediment to economic growth.

More than 91% of investors surveyed by Bank of America Merrill Lynch believe that the pension reform will be carried out in 2019, and a third of those surveyed expect it to be approved in the first half of the year.

At the end of November, the level of debt of the Brazilian government was over 75% of GDP, according to data from the Brazilian Central Bank.

Maintaining payments into retirement funds has been a major financial headache.

To reform the current system, Bolsonaro proposes increasing the retirement age from 60 to 62 for men, and from 55 to 57 for women. He has also issued a decree that reverses some benefits provided by the state.

“The bias of the new government in favor of privatization and a smaller government will lead to a reassessment of a series of state-controlled companies,” say strategists at MRB Partners.

It is through this line of free market thinking and decentralization that Bolsonaro is steering Brazil to the top of emerging markets, and the country promises to continue growing.

So much so that Brazil began the year as the best-performing stock market in the world, and Wall Street’s new favorite.

Versión Español

Versión Español