Spanish – Spain has been one of the most affected economies in the Eurozone due to the coronavirus crisis. The International Monetary Fund (IMF) forecasts an 8% reduction in economic activity. The Spanish government estimates that the fall will be 9.2%, and according to data from the Fundación Civismo, the Spanish economy could even reach a contraction of 11%, a forecast 1.5 % higher than the Spanish government’s most pessimistic scenario. The shock is expected to be transitory, but everything will depend on the evolution of the pandemic.

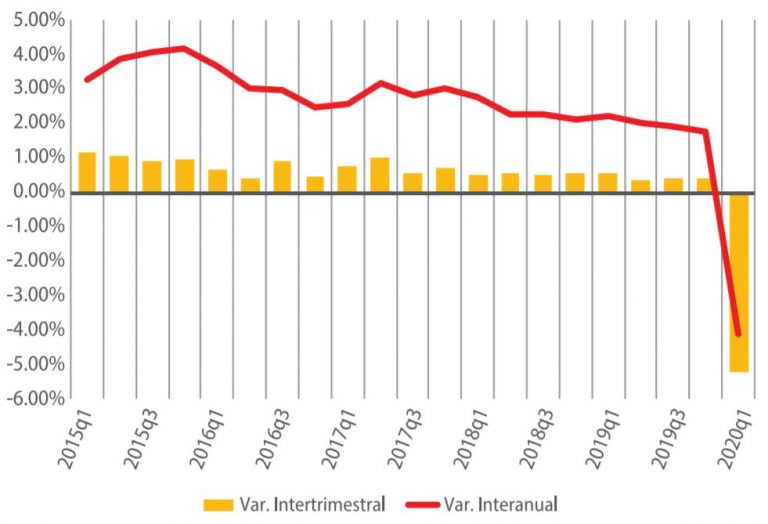

In its most recent report on the performance of the Spanish economy in the first quarter, the Juan de Mariana Institute and UFM Market Trends note that the Iberian country’s economy has gone from growing above the eurozone to having a contraction larger than the regional average.

The report highlights that in Spain, the cyclical sectors that depend on credit loans, such as automobiles and housing, fell steadily in recent months. The automobile sector, which had already been suffering from a series of economic misfortunes, including reduced demand due to the economic slowdown- particularly from China and India- as well as structural ones, technological disruption, or regulatory threats, has recently shown unprecedented rates of contraction. In April, only 4,764 vehicles were registered for tourism, compared to 130,254 in the same month in 2019 (a contraction of 96% year-on-year). If we look at the last three months, including April, we observe a 64% drop compared to the same period in 2019.

Construction contracted by 8.6% compared to the first quarter of 2019. The reduction in the primary sector and industry was 2.5% and 2.2%, respectively. The services sector is where the divergence has been greatest. The sector as a whole fell by just over 4%. Further, there were sharp contractions in commerce, transport, and hotels (-9.7%), and arts, recreation, and other services (-10.7%). On the upside, financial and insurance activities grew by 6.9%, and public administration, education, and health activities by 2%.

The Juan de Mariana report shows that retail sales were also significantly affected. In annual terms, sales in April were down by 31.6%. The maximum rate of contraction in the 2008-09 crisis was 8.5%, and in the 2012 crisis, it was 11.4%. In other words, retail sales in the Iberian country had never contracted as much as they did in 2020.

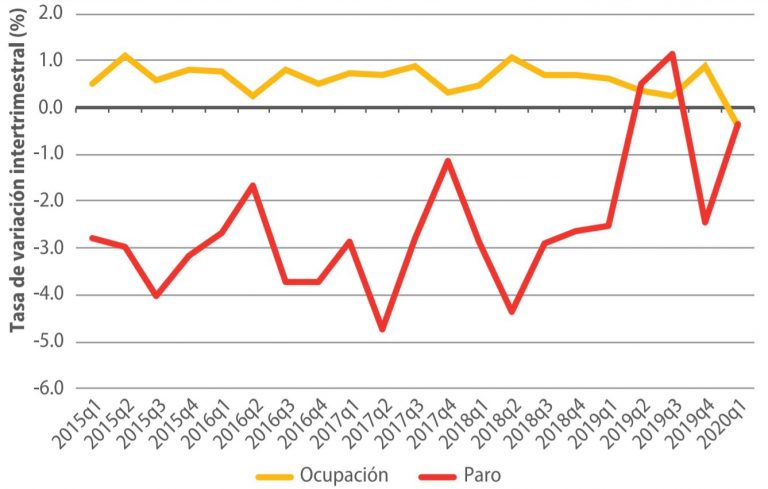

The employment rate showed a negative change for the first time since 2013. The number of employed people fell in the first quarter of this year by 285,600. Practically all of the new unemployed belong to the private sector, according to information from Juan de Mariana.

Dr. Juan Ramón Rallo, a Spanish economist and professor, is concerned that Spain has no fiscal space to extend the debt contracted to deal with the pandemic. The public deficit is expected to exceed 10% this year, raising the liabilities of the Spanish economy, which could reach 115.5%. By 2019, the debt to GDP ratio was already 95.5%.

Este gráfico lo explica todo. No quisisteis reducir la deuda pública, a pesar de que Alemania os instaba a ello, y ahora, como vuestra capacidad de nuevo endeudamiento está constreñida, queréis que Alemania financie vuestros megaplanes de gasto público futuro. Pues no. https://t.co/fyNQMPninb pic.twitter.com/pJgi213jyk

— Juan Ramón Rallo (@juanrallo) April 9, 2020

La ceguera de ciertos gobiernos del Norte trajo sufrimiento a los pueblos del Sur, fue un fracaso económico y sentó las bases materiales para el resurgimiento de la ultraderecha. Cometer el mismo "error" una segunda vez podría dejar herida de muerte a la Unión Europea. pic.twitter.com/laOUY0iBnJ

— Pablo Echenique (@pnique) April 9, 2020

According to the Juan De Mariana Institute and UFM Market Trends, the Spanish economy is entering a recession. But they find that the adjustments made in the Spanish private sector would minimize the risks of the fall. However, the risks would be mostly concentrated in the public sector and economic policy.

The Spanish economy already suffers from high levels of debt, and the current government coalition between the Spanish Socialist Workers’ Party (PSOE) and Podemos has refused to reduce it. Thus, it will be difficult for Spain to have much room to maneuver in its finances during the current crisis. Germany has already refused to back Pedro Sánchez’s government to apply for more loans. Although the European Central Bank has approved a new monetary stimulus of more than 600 billion euros, this will be distributed throughout the Eurozone. To revive the economy, Pedro Sánchez’s government will probably have to liberalize it and support measures to stimulate investment and consumption to boost Spanish aggregate demand.

Versión Español

Versión Español