EspañolBy Diego Sánchez de la Cruz

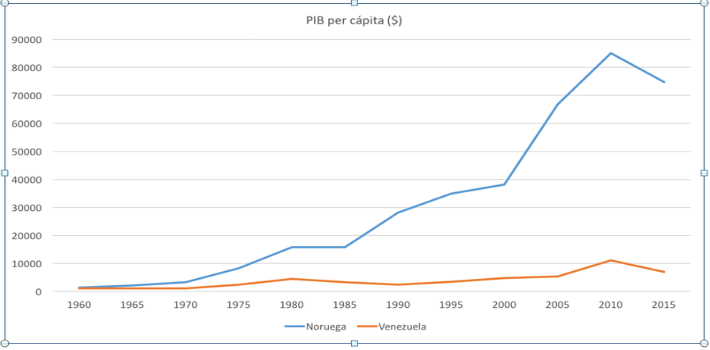

In the 1960s, Venezuela and Norway had a similar per capita GDP. Thanks to abundant commodities, both the Latin American country and the Nordic republic looked ahead to the future with significant prospects for development and progress.

But their paths since then could not have been more different. As Norway became one of the richest places in the world, Venezuela experienced decades of stagnation that led to the current socioeconomical meltdown.

One of the main reasons for Venezuela’s stagnation is the lack of opportunities generated by its interventionist economic model.

From Rómulo Betancourt to Hugo Chávez and Nicolás Maduro, Venezuelan leaders have intervened in the economy in a thousand different ways.

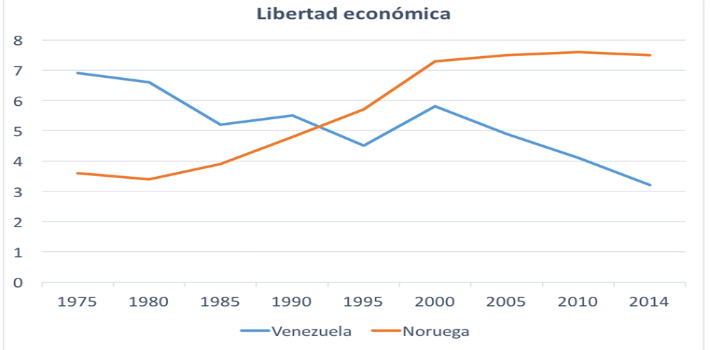

Back in 1975, Venezuela had a score of 6.9 points out of 10 in the Fraser Institute’s Index of Economic Freedom. Over the years, the country’s rating has gone down, dropping to 3.2 points in the latest edition.

While Venezuela went down the road to serfdom, Norway was a different story: from a score of just 3.6 in 1975, it climbed to 5.7 in 1995, and 7.5 in 2015.

Norway’s Capitalist Turn

But Norway wasn’t always a free economy; during the 1970s interventionism was commonplace. The democratic left proudly used it as an example of their success.

Actually, the Norwegian economy was deeply reliant on oil, and the state wielded enormous power over the market.

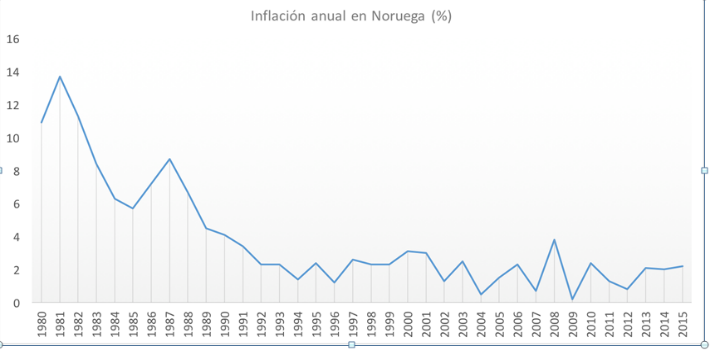

Norway’s first major step toward development was defeating its double-digit inflation. Amid the growing influence of Friedrich Hayek and Milton Friedman, many countries transformed their monetary policies with an eye on classical liberal ideas.

The inflation rate duly dropped from around 10 percent to 2 percent. Overcoming this hurdle took Norway from a 6.4 score in the aforementioned index’s monetary stability category to 9.6 points.

This is in stark contrast with Venezuela’s dire situation: its currency has steadily lost purchasing power, reaching unbearable hyperinflation rates that harm the entire population.

Norway’s Recipe for Success

Although Norway is not a member of the European Union, it did sign the European Free Trade Agreement. Therefore, it can reap the benefits of the European market while avoiding Brussels’ bureaucracy and interventionism.

In addition, labor market regulations are reasonable, and the business climate is favorable (ranked 9th in the World Bank’s Doing Business report).

But the Norwegian economy’s greatest strength are its exemplary institutions, which protect property rights and uphold the rule of law.

Norway has one of the most independent judiciaries in the world. There is no military interference in political institutions, hardly suffers from the scourge of corruption, effectively endorses contracts…

In all these categories, Venezuela is the exact opposite. Protectionism is the norm, regulations are markedly anti-capitalist, the labor market is mostly informal, and doing business is a daunting task. In addition, institutions suffer from rampant corruption, which has only gotten even worse over the last three decades.

To all this, we must consider political freedom. Contrary to the liberal, representative, plural, and open Nordic democracy, the Chavista regime is overtly repressive, authoritarian, and incompatible with the most essential civil and political rights.

The Norwegian Fiscal Dilemma

Nevertheless, Norway is not perfect. Despite the amazing progress over the recent decades, the country lags behind in a number of issues that hinder its growth potential. To a large extent, these shortcomings have to do with the excessive burden of public spending and taxes.

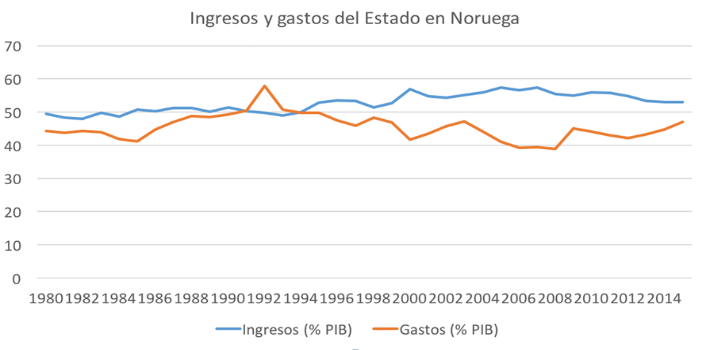

Regarding the tax burden, tax revenues amount to 53 percent. However, we must make two important clarifications:

On the one hand, the Norwegian tax system is well designed and does not introduce large distortions. Norway ranks 11 in the Fiscal Competitiveness Index.

On the other hand, oil income “inflate” tax revenues by four percentage points of GDP compared to the OECD average.

The extremely high taxes levied by Norway are clearly incompatible with a 21st century economy. For this reason, Norwegian authorities are introducing reforms to reduce the corporate tax, which will drop from 27 percent to 23 percent.

The basic rate of income tax will also be cut from 27 to 23 percent. Norway has already eliminated the inheritance tax, and is planning on eliminating the estate tax as well.

Regarding public spending, it is important to explain that about 18 percent of the Norwegian state’s annual expenditures come from dividends of the national sovereign fund, a gigantic financial vehicle that invests successfully in stocks and markets across the world.

Thus, US$20 billion of public spending every year come from the fund, from a total expenditure of around $225 billion.

For a Prosperous and Free Venezuela

If Venezuelans look at Norway’s history they will see that, starting with similar initial conditions and resources, their paths could not have been more different.

Comparing models like this is an important way to detect the ideas that bring about progress and those that don’t.

Only by winning the battle of ideas we can help Venezuela finally dismiss the socialist fantasies and embrace the liberal institutions that will take it out of its crisis.

Versión Español

Versión Español