By Aurelio Concheso

For most citizens, monetary issues arouse deep disinterest or confusion.

And how could they not? Issues like this are not in the daily economic debate for citizens who are only concerned about their survival in a country defined by scarcity.

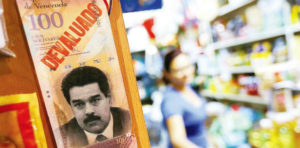

Back in 1922, the Germans suffered the first hyperinflation of the 20th century. They were vaccinated for a century against populist promises based on mass printing of money. Nowadays, Venezuelans are suffering through some of the most irresponsible monetary policies in recent memory, and have the right — even the obligation — to know the cause of their subsequent suffering.

Prices soar when a monetary authority (in this case, the Central Bank) prints more money without a backup (fiat money). If there were a million Venezuelan bolivars to buy certain goods, and five more millions of bolivars are suddenly put into circulation for the same items, prices would skyrocket.

Well, that is what the Board of the Central Bank of Venezuela (BCV) has been doing, as statistics show.

On September 2, 2016, liquidity was around VEN $6.142 billion and reserves were around US $11.9 billion. Three years ago, Nicolás Maduro’s newly installed adminstration “only” had VEN $911 billion in circulation, and US $23 billion in reserves.

In other words, 85 out of every 100 bolivars in circulation today was not in existence in September 2013. Moreover, dollar reserves have declined by half in the last three years, while goods available shrinking by 20 percent. It is not surprising that with this monetary frenzy, prices increased by 180 percent last year, and almost 500 percent this year.

But the BCV is determined to put out the fire using a gasoline hose. The institution continues printing money, putting the economy on pace to have VEN $12 billion in circulation by September 2017.

To maintain the false narrative that the government is not to blame for the increasing prices, Maduro has created an illusion of control with SUNDE — the police for prices. Thus, authorization for formal private enterprises can take months and even years, deepening the shortage of essential commodities even further.

This monetary chaos is not due to ignorance or inexperience, but if you aren’t sure, just heed the words Austrian economist Ludwig Von Mises, who in 1922 brought his country’s Council of Ministers out to the front of the Austrian National Bank.

“Hear that noise?” He said, pointing to the building. “That is the sound of the Bank’s machines printing more money. If you want to stop hyperinflation, turn them off!”

Aurelio F. Concheso is a mechanical engineer from the Massachusetts Institute of Technology (MIT). Concheso is an entrepreneur, and the moderator of the economy radio show “Laotravía” .

Versión Español

Versión Español