EspañolFrom August 15, residents of the Dominican Republic will be required to pay an 18 percent tax on all internet purchases, which means an end to the exemption for purchases worth less than US$200 — in line with retail trade on the island.

The new policy, released on August 6 by the Directorate General of Customs (DGA), will replace Decree No. 402-05, in force since July 26, 2005. As a result, however, the United States may apply economic sanctions on the island, since the change violates certain international agreements.

The Dominican Alliance for Consumer and User Defense (ASODECU) and other consumer groups are less than pleased with this development. Already, they have filed a class action lawsuit before the Supreme Administrative Court (TSA).

According to an ASODECU statement, the tax policy change is illegal and unconstitutional, since Decree No. 402-05 supersedes the DGA’s legal authority.

The consumer-advocacy group also argues that this internet tax will contravene free trade agreements in effect between the Dominican Republic, Central America, and the United States (CAFTA-DR). The group further contends that the order violates judicial independence and the separation of powers.

“It is outrageous and abhorrent that an institution like Customs, in a purely administrative fashion, would aim to modify the express mandate of a decree, which also formed part of the approved policies within the framework of the CAFTA-DR,” said José Burdie, ASODECU president.

The DGA responded in a statement: “Up until now, the policy of not taxing goods purchased and imported valued at $200 or less was in place because the cost of collection was greater than the actual tax revenue gained. However, this has now changed, and the growth of internet shopping has caused a substantial fiscal impact based on the loss of that annual income. This has caused competition to be distorted in the local market, creating inequality in the way consumers are treated.”

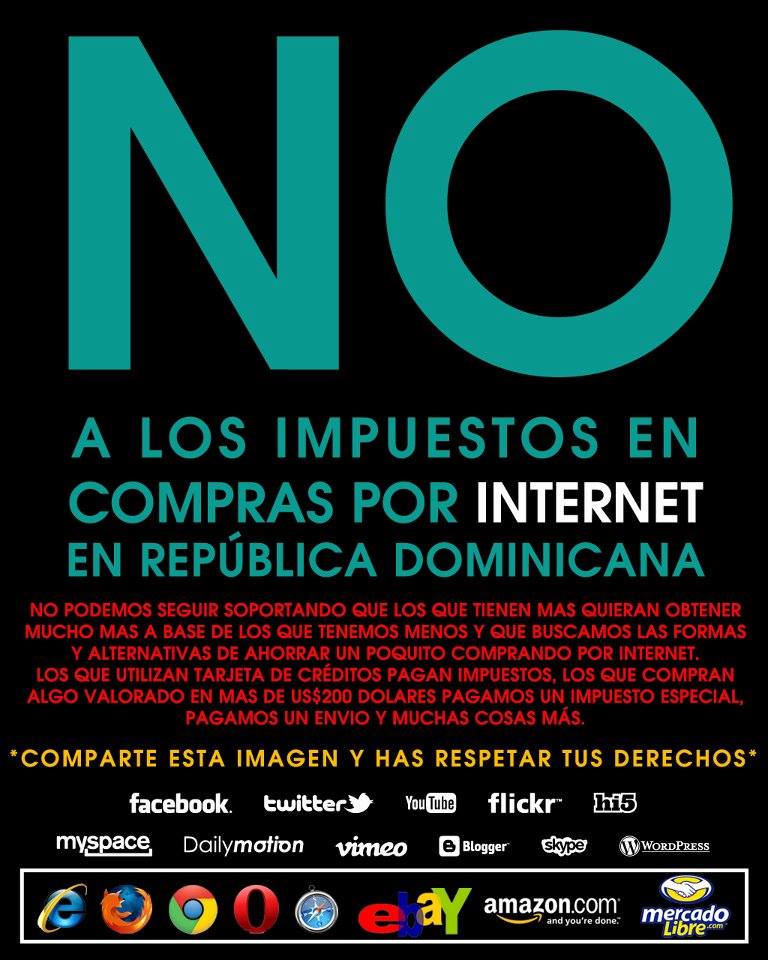

RT Si No estas deacuerdo con el impuesto a las compras por Internet -200 dólares #NoImpuestoComprasInternet pic.twitter.com/oAOweVxwoW

— Cliente Dominicano (@ClienteRD) August 7, 2014

Dwindling Support

Former Dominican President Hipólito Mejía (2000-2004), initially came out in support of the policy to begin taxing internet purchases. He assured the public that the change was necessary to protect the interests of the country, local businesses, consumers, and the productive sector in general.

Shortly thereafter, however, Mejía reversed his position when faced with growing criticism from Dominican consumers. In addition, both his Revolutionary Majority Party and one its key leaders, Luis Abinader, rejected the change. He now says he would like to see the tax policy applied only to those importers who use the internet to get around local laws.

“The government should continue to exempt internet purchases up to $200, in light of the existing legal framework,” said the former president in a press release. And he wants prompt action on the matter: “Internet purchases must be regulated to protect individual consumers, made up of young, middle-class consumers. Such regulation should protect the interests of the state, merchants, and the productive sector from unfair practices.”

Customs chief Fernando Fernández has estimated the revenue gain at $130 million annually, and Mejía has likewise indicated that the policy change is geared toward tax revenue: “[It] penalizes thousands of citizens who make small, individual purchases under existing law and are stretching their tiny budgets.”

Potential US Sanctions

According to the president of HM Consulting, Hiddekel Morrison, the Dominican Republic faces likely economic blowback from the revoked tax exemption, in the form of sanctions.

“The CAFTA-DR prohibits the raising of taxes and protects the producers in their respective countries,” Morrison said during an interview on the program Doble Cara. He later added that the tax policy penalizes the middle class and internet commerce.

Versión Español

Versión Español