EspañolVarious Latin-American governments have recently taken steps to regulate the use of bitcoin and other cryptocurrencies. On July 24, Ecuador’s parliament, through a majority vote, approved the Monetary and Financial Code, which in addition to creating a top-down, state-run digital currency, also prohibits all unofficial digital or physical currencies.

A group of young bitcoin users known as BitcoinsEcuador on social media networks decided recently to look for new business opportunities with bitcoin. They purchased an ATM on the internet for US$5,000 and began an exchange service where people could cash in their virtual currency for dollars.

However, once it became clear that the passage of the Monetary Code was only a matter of time, the group of entrepreneurs grew concerned about how the legality of their business may be threatened. On July 3, they decided to ask Ecuadorian authorities directly how they should proceed. The Ecuadorian government responded weeks later, taking issue with the group’s enterprise and use of forbidden currency under the new code, and asked that they shut down.

The group of bitcoiners told the PanAm Post: “We decided to stop speculating [whether or not it was legal] and write three letters directed at the Central Bank of Ecuador (BCE), the Superintendency of Banking and Insurance, and the Internal Revenue Service, explaining the business that we wanted to establish. We received replies from two entities where we were asked to either refrain from these activities, or to conduct them outside of the Republic of Ecuador.”

The group complains that their purchase of the ATM was not easy. “The process took about three months and involved [additional] costs of $1,300, including liquidation costs at Customs (AD-Valoren, FODINFA, IVA), registration with the BCE, and payments to FedEx,” they said.

Gustavo Solórzano Andrade, general manager of the Central Bank, concludes in his response letter that “according to the law, the only legal currency in Ecuador is the US dollar, the same currency used in all economic operations through payments authorized by the Central Bank of Ecuador.”

“In this regard, if an Ecuadorian citizen would like to invest in bitcoins or some other cryptocurrency, it would be a personal and individual decision and it would need to be done outside of Ecuadorian territory,” Andrade added.

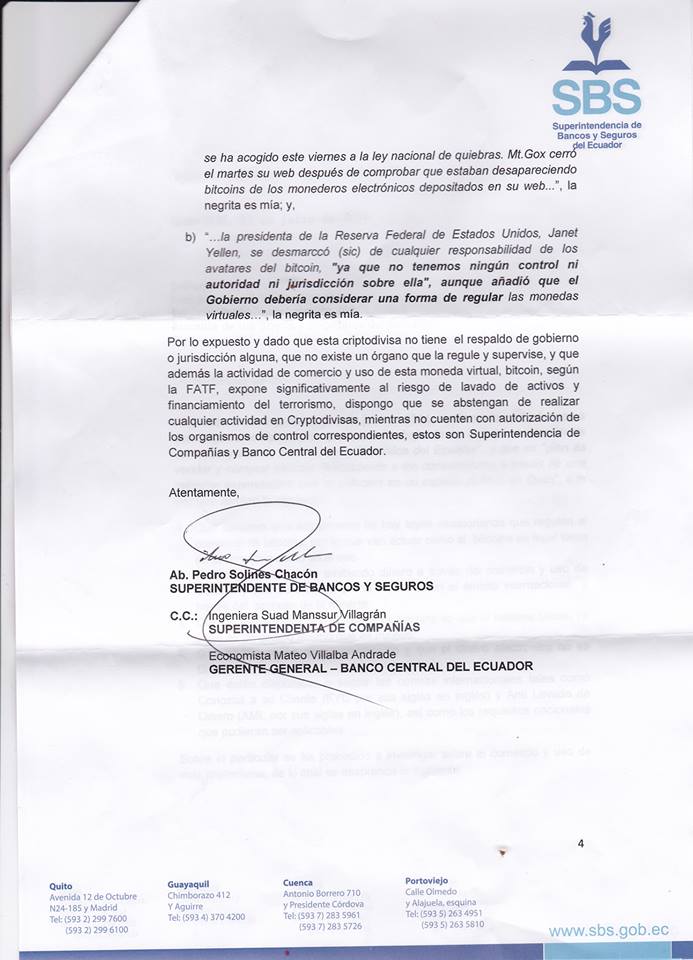

Meanwhile, the Superintendency of Banks and Insurance responded in a separate letter to the group’s request regarding the bitcoin ATM in Quito, Ecuador.

Superintendent Pedro Solines Chacón stated that “since cryptocurrency does not have a regulatory or supervisory body, in addition to the assessment of the FATF (Financial Action Task Force) that the commercial activity of this virtual currency, bitcoin, exhibits significant risk of money laundering and terrorist financing, I order you to refrain from any activity in cryptocurrency exchange until authorization has been granted from corresponding controlling entities, the Superintendency of Companies and BCE.”

Solines Chacón based his decision in part on comments made by the chair of the US Federal Reserve, Janet Yellen, in which she said the Fed had no “authority to supervise or regulate bitcoin in any way.”

Argentina Tightens Bitcoin Controls

The Santander bank and the Galicia bank, in its Argentinean subsidiaries, have closed two bank accounts belonging to Unisend, the first bitcoin exchange company in the country. The banks acted based on Article 792 of the Argentinean Commercial Code.

Unisend issued a statement on Sunday explaining the company had not been informed of the reasons for the closures, and beginning on Monday, they would cease accepting any deposits or transfers to accounts belonging to these banks.

According to the article of the commercial code that these banks cite, a bank may close any account, at any time, and for any reason: “The bank account can be closed when requested by the bank or client, prior notice of 10 days in advance, unless otherwise agreed.”

In its statement, Unisend responded: “We believe this measure is discriminatory and arbitrary, since we complied with all requirements and regulations.”

The company says both of their accounts were shut down within five days of each other and that each closure notice was delivered by certified mail.

Unisend also states that while they cannot receive any more deposits, those who wish to continue operating may do so through other means of payment (Easy Pay, Rapid Pay, etc.). The company also explained that deposits and withdrawals made in cryptocurrency are not disturbed in any way.

On July 10, Argentina’s Financial Intelligence Unit (UIF) issued Resolution 300 ordering all financial institutions to report all transactions made with digital currencies, in an effort to prevent money laundering operations and the financing of terrorism.

According to Article 4 of the resolution, currency exchange agencies, brokerage firms, banks, and other financial institutions must report all activity everyone month beginning August 1.

The PanAm Post contacted Unisent to clarify if the closure of their accounts had anything to do with the implementation of this new law a few days ago. The company responded by saying they will be “further investigating the motive.”

Unisend is the only bitcoin exchange agency in Argentina that works with bank accounts.

Versión Español

Versión Español